400-050-7798

400-050-7798- Stock Code : 300662

-

中文CN

中文CN

-

Talent Solutions

Talent Solutions

As a new round of industrial revolution accelerates and new business model emerges, we support you in your talent placement and business development with a package of talent services. It empowers you to gain a competitive edge in the global talent acquisition and enhances your organizational effectiveness.

- Dedicated Talent Service

- HR SaaS

-

Recruiting Platform

Recruiting Platform

Career International has developed vertical recruitment platforms specialized in the niche fields of big health, retail and digital technology. Leveraging full-matrix online products, the job portals provide a suite of services including job ad release, online communication with candidate, high exposure via channels, smart job-talent matching, etc. that cater to various needs of employers. With high coverage, wide accessibility, and real-time effect, the platforms can bring together top candidates effectively in related areas.

- Partner Platform

-

Careers

Careers

Career International has developed vertical recruitment platforms specialized in the niche fields of big health, retail and digital technology. Leveraging full-matrix online products, the job portals provide a suite of services including job ad release, online communication with candidate, high exposure via channels, smart job-talent matching, etc. that cater to various needs of employers. With high coverage, wide accessibility, and real-time effect, the platforms can bring together top candidates effectively in related areas.

- Insights

- Our Company

Realtime platform update

Realtime platform update Expert answers to business

queries

Expert answers to business

queries All-round interaction mechanism

All-round interaction mechanism

1-to-1 service assurance

1-to-1 service assurance

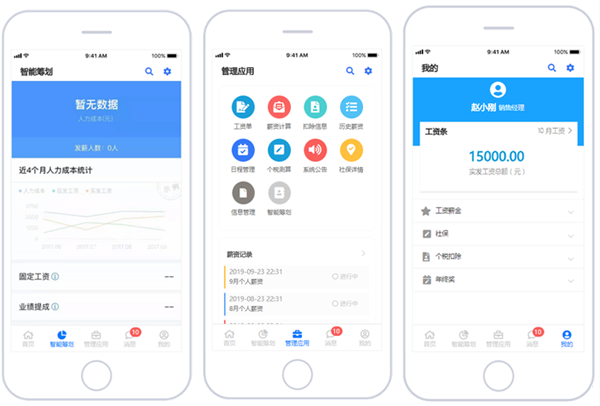

Download

Download