Industry Overview

The ‘big health’ industry in China is flourishing in 2019 and is predicted to exceed 10 trillion yuan in 2020. With favored government policies, aging population, and improved living standards, the healthcare industry is embracing development opportunities and bright prospects.

Pharma

Economic development, aging population and technological innovation are driving the healthcare industry forward fast with a changed growing pattern. To pursue growth with more products and sales doesn’t work effectively as before. Facing significant profit loss of generic drugs against the backdrop of China’s drug bulk-buy program, drug makers now turn to innovation. An increasing number of innovative SMEs are developing vigorously and gathering talents and resources. It has been driven by positive government policies and the launch of sci-tech innovation board (STIB) at Shanghai attracting the attention of capital markets on new tech start-ups. Local Chinese pharmas begin to realize that innovation powers productivity. Therefore, players in the field are developing R&D teams in their strategic transition from “copycat medicines” to “self-developed drugs”.

Changes in the market environment have caused adjustment to pharma sales. However, the demands for sales reps of specialty drugs and innovative drugs still remain. It comes both from established foreign and domestic pharma companies, as well as from start-ups with new drugs launched in 2019. Specifically, start-ups need more director-level-and-above talents, especially in the area of antibody therapy and gene therapy. The great success of Anti-PD-1/PD-L1 therapy in tumor immunity has led more companies to increase investments in the entire industry of biologics, especially in new antibody, double antibody and multi antibody. Besides, the demand for small-molecule drugs rebounds, with growing needs for talent in the domain.

Clinical research and development: The CDE reform has accelerated drug review and approval; the era of innovative drugs has come, favored by capital investments and huge market demands in China. Needs for clinical talents are active given the large population and rich medical cases China has. Candidates involved in the field of new product launch, PM and CRA, biostatistics, and drug safety are in large demand, and talents in the domain of cancer and immunization are in short supply. Besides, veteran managers are much sought after by drug manufacturers and CROs. As to clinical talent mobility, employees are found more loyal in the established pharma MNCs; and the management staff at pharma start-ups is generally professional managers with years of working experience at foreign enterprises, who are believed to boost SOP as a cultural fit; while the traditional Chinese drug makers are more flexible with their talent recruitment, introducing both seasoned candidates from MNCs to standardize their clinical operations, and also experienced middle management from domestic firms. These companies develop pharma R&D with capitals generated mostly from the production of BPC and distribution of brand drugs.

Drugs centralized procurement: A new round of drugs centralized procurement led by the National Healthcare Security Administration has opened the tender, which is believed to speed up the coming of one-invoice system. It marks a new normal in China’s pharma industry with new program allowing “up to three contractors” and the founding of drug joint procurement office. It will change the industry fundamentally.

Faced with new situations, the pharmas winning the bidding are resolved to increasing new drug R&D and introduction and reducing production costs quickly on one hand, and to accelerating the pace of mergers and acquisitions on the other. While the losing firms move to small town and rural market, focus on CHC and OTC, and adjust their product structure against the retailing trend of prescription drugs. Also, they try to facilitate competitiveness by looking for diverse channel marketing with the aid of ‘Internet plus’. The price competition initiated by the national drug procurement reform forces domestic pharma companies to enhance their core competitiveness with transition from marketing-driven to R&D-driven enterprises.

Adjuvant drug use: The share of adjuvant drugs covered by national health insurance will get reduced. In July 2019, the National Health Commission released the First Batch of Controlled Medication (chemical drugs and biological products) for Rational Drug Use, And a total of 20 kinds of chemical drugs and biological products were included. It would help them to be used more rationally, and prescribed with clinical indications only. Though Chinese medicine was not included in the list, its prescription would be under restrictions with market size estimated to shrink by at least 50%.

There is bubble in domestic hiring market, with talents expecting compensations higher than their counterparts in America. Therefore many pharma companies are starting to look for talent overseas, or choose to open R&D center in USA.

Talent Gaps: Oncologist, Chief Medical Officer, Clinical Operations Director, Clinical Project Manager, Registered Manager, Biostatistician, Market Access, Marketing, Government Affairs

Talent Sources: peer companies, multinational pharma companies

Medical Equipment

Under the impetus of medical reform, China's medical device industry is ushering in a period of high-speed development. Talent in R&D, quality, clinic, registration and other upstream positions in medical equipment will be popular among employers in the next five to ten years. And top R&D management personnel are in short supply.

With key technology breakthroughs, China’s device makers turn their attention from low-end market to the middle and high-end one. Many outstanding local enterprises emerge in the areas of high-value medical consumables like imaging, in vitro diagnosis (IVD), genetic testing, and cardiovascular disease treatment. And talents in these fields are embracing great opportunities. There is a talent shortage in clinical administration. Operation and management candidates are also in hot demand, and versatile talents are proved more competitive.

Talent Gaps: Clinical Project Manager, IVD R&D Director/Manager, High-Value Consumables R&D Director/Manager, Project Transition Manager

Talent Sources: foreign/domestic manufacturers of medical devices and biopharmaceuticals, and overseas high-end R&D talent market

Big Data in Healthcare

Big data is changing healthcare industry. With increasingly high volume of medical data, data processing and application become challenging. Besides, China is plagued with growing incidence of chronic disease, inaccurate clinical decision, uneven allocation of medical resources, and repeated diagnosis and treatment. Therefore, it is advisable for enterprises to work with government and hospital to get high-quality data. Moreover, analysis of medical data requires the support of technologies like cloud computing and artificial intelligence. They are expected to be applied first in chronic disease treatment, auxiliary diagnosis and medical research. In short, the interconnected data mining platform will be the priority of development in the future.

Talent Gaps: Medical Manager, Clinical Project Manager, Clinical Statistical Programming Manager, Real-World Study (RWS) talent, Product Manager, Pre-sales Consultant, Deep Learning Researcher, Marketing Director

Talent Sources: hospitals, medical device manufacturers, informationized pharma companies, Internet/IT enterprises, research institutes of colleges and universities

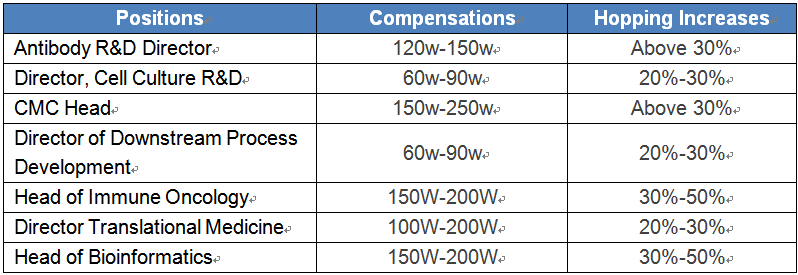

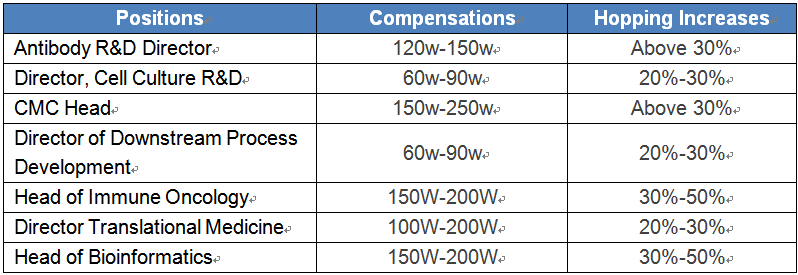

Hot position salaries and hopping increases

Salary Trends

Compensations in the industry are to see a steady growth of around 10% in 2019 according to predictions. Job movements among the same type of companies could bring 30% or above salary hikes. And some start-ups are offering equity and share incentives apart from wages to attract overseas returnees.

400-050-7798

400-050-7798 中文CN

中文CN

Download

Download